The UK faces a deepening housing crisis, with demand growing and supply constrained. Significant household growth, low levels of affordability and a lack of access to mortgages are driving the strong, long-term demand for rental homes

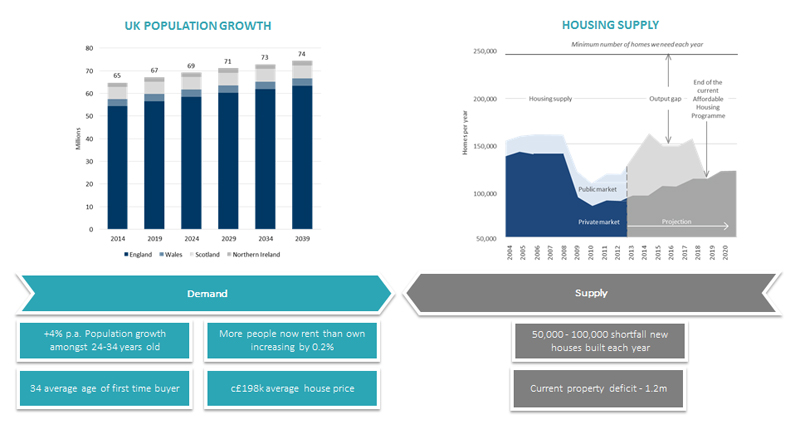

Longevity, migration and higher birth-rates are projected to increase to 70 million by 2029 (Source: ONS). Official projections suggest that the number of households in England will rise to at least 26 million by 2026, an increase of between 220,000 and 225,000 new households each year, with around 70 per cent. of these new households being one person households.

When other requirements are added, for example, for second homes, it is estimated that an additional 242,000 dwellings will be required each year, comprising 145,000 market homes (60 per cent. of total); 30,000 affordable homes (12 per cent.); and 67,000 social rented homes (28 per cent.) (Source: Research by Shelter – Homes for the Future, 2008).

Most growth in housing has come over the past decade from households seeking accommodation in the private rented sector. There were 1.8 million more households renting privately in 2010 than there were in 2000. Overall this has meant that the private rental sector has grown from 10 per cent. to 17 per cent. of the housing market in a decade and one-in-five households are predicted to be renting privately by 2020 (Source: PwC analysis of English Housing Survey, 2015).

Residential property is the UK’s largest investment asset class (approximately £4,224 billion) of which the IPD Market Let Residential Index covers only £2.3 billion of residential assets. On a total returns basis it has been the best performing property investment asset class over most timeframes over the past thirty years (Source: [British Property Federation, Investing in Residential Property, 2013]).

Recognising the wide and growing supply-demand gap, there is now also strong political support for institutions investing in residential property, which has been in evidence recently, via the Montague Review of Housing Investment, institutional support from the likes of the HCA and more general direct aid to the development industry.

Accordingly: (i) the sector is very large and capital intensive; (ii) the embedded UK housing supply and demand gap is attractive for investment, and (iii) long-term private sector (equity and debt) financing is required.

There is an opportunity to invest substantial capital into long term UK property assets at a time where the investment case is attractive.